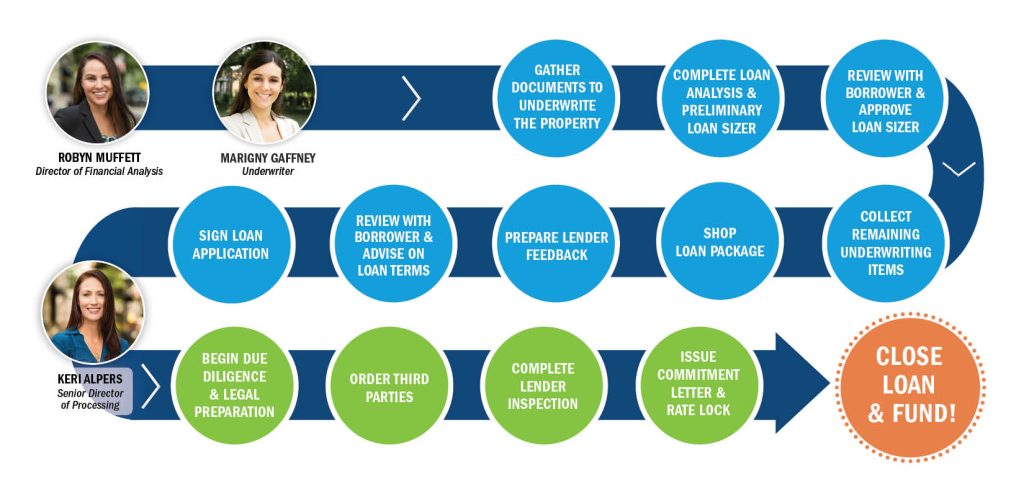

1. Gather Documents to Underwrite the Property

Loan analysis and preliminary loan sizer are important tools used by Sweetwater Capital to determine the loan amount available for a specific property. In most cases, a trailing 12-month operating statement and a current rent roll will be required to underwrite a property, as well as additional property and sponsor specific information.

2. Complete loan analysis & preliminary loan sizer

The loan analysis process involves analyzing the property financials, target financing goals, and sponsorship experience. The underwriting team reviews the data from the collected documents to understand the property performance and how best to achieve the target loan amount.

A loan sizer analyzes property financing potential using the data from the operating statements and the rent roll. Loan sizers can be completed for the property exactly as the property is operated, as a lender would underwrite, and potentially a proforma to reach target goals.

3. Review with borrower & approve loan sizer

Approving a loan sizer is the next step in the loan process. It requires both the borrower and the broker to review the details of the loan sizers to understand what loan amount can be achieved in which circumstances. With careful review, both parties can ensure that they are comfortable with the loan amount that will be requested.

4. Collect remaining underwriting items

A comprehensive loan package is created that explains the property amenities and performance, market, and borrower experience to present to potential lenders. A list of items needed to complete the loan package is sent to the borrower to create the loan package. The loan package groups all the information about a deal for a lender to review and underwrite by lender standards.

5. Shop loan package

Sweetwater Capital shoulders that burden for our borrowers by sending a loan package out to multiple lenders for the best quote by having the lenders compete for the business opportunity.

The underwriting team scours a database of over 4,000 lenders across the nation to choose lenders most likely to offer a loan that matches the key loan targets desired by the borrower. The underwriter presents the deal to the group of lenders and collects quotes.

6. Prepare lender feedback

All received quotes are put together in a document in an easy-to-read format for a side-by-side comparison of the terms from each lender and categorized by each loan program. This format allows the borrower to quickly see which lenders are offering the terms that fit the financing goals.

7. Review with borrower and advise on which quote meets the needs of the borrower

The broker presents the lender feedback chart to the borrower and walks through quote; pointing out the pros and cons. By reviewing this document together, the broker and the borrower can determine which quotes are attractive to the borrower and narrow down to the lender the borrower would like to proceed. Once a final lender is chosen, the application is requested from the lender.

8. Sign Loan Application

Upon receiving the application, the team reviews the document to make sure all terms match the quote chosen and then presents the application to the borrower for signature. The signed application formally engages the lender and the due diligence begins.

9. Due diligence and legal preparation

Due diligence and legal preparation are essential steps when it comes to loan transactions. Once an application is signed the processing department will collect all the items that are needed to close the loan. The team will work with legal counsel to ensure the legal due diligence is in process at the same time as the underwriting due diligence items are being collected. The processing team will also work with the insurance agent to get all necessary insurance information into the lender.

10. Order third parties

Once the application is signed the processing department will work with the lender to have third party inspections ordered. Sweetwater Capital works hard to have all inspections done on the same day to avoid interrupting the property as much as possible.

11. Complete Lender inspection

A lender inspection is an essential part of the loan process. The lender always wants to see the collateral they are lending on. Sweetwater Capital will try to have the lender at the property at the same time as the other third-party inspectors.

12. Issue commitment letter and rate lock

Once the underwriting is completed by the lender and the loan is approved the lender will issue a commitment letter. This letter will state the approved loan amount and terms. The letter will also state any rate lock and closing conditions. Sweetwater Capital will go over the commitment letter with the borrower and work with them on all the rate lock conditions.

Once the commitment letter is signed and the rate lock conditions are met Sweetwater Capital, the borrower and the lender will have a call to lock the rate.

Shortly after the rate lock the loan will close.