There is a process to use the same initial investment to build apartment communities over and over again, utilizing a refinancing strategy used by Serial Multifamily Developers.

My team works closely with developers of apartment communities to obtain construction loans with banks and permanent loans through Fannie Mae and CMBS “Conduit Lenders”. Our expertise is permanent long-term financing, which is the final step in developing an apartment community. The developer gets their equity back when the permanent loan is closed. We assist our clients well before financing is needed by providing them with guidance on achieving the maximum permanent loan so they can pull cash out of the finished project to invest in a new one.

Capstone Capital helps borrowers attain “serial developer” status by providing financing that allows the developer to get their equity back and reinvest into new multi-family communities. A long-time client of Capstone Capital, Tom Holderby, refinanced his 264 unit property in Burlington, North Carolina. The property, Woodland Heights of Burlington, had existing debt of $13.15 million and Holderby invested approximately $3 million in equity. Capstone Capital helped Holderby close a $17 million loan in 2013. “I had a ton of equity trapped in Woodland Heights. I wanted to build more apartment communities but all my cash was tied up. Capstone Capital showed me how to pull my cash out through their financing,” said Holderby. He used the funds to invest in two more apartment communities in North and South Carolina.

Here is the strategy:

Developers, such as Holderby, have a desired loan amount they must achieve during permanent financing. This is referred to as the TARGET LOAN AMOUNT. The TARGET LOAN AMOUNT equals the construction debt PLUS the cash the developer originally put in as the down payment required by the construction lender. After the project is built and leased up, it is time for permanent financing. The following walks through the process using Tom Holderby’s new apartment community development as an example. We refer to Holderby as the developer, the borrower and the owner as we discuss the process.

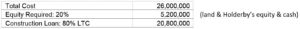

The financial model below demonstrates how to achieve recoupment of the developer’s initial investment (20%) upon closing the permanent loan.

In this example, the total cost of the project is $26,000,000.

Construction Loan Constraint – Loan to Cost

During development, the construction lender loans 80% Loan-to-COST (LTC). LTC formula is used in underwriting a construction loan and it expresses the amount of a proposed loan as a percentage of total project cost, thus requiring the developer to put 20% of equity in the form of cash or land in to the project.

The developer funds $5.2 million, which is the 20% required by the bank for the construction loan. The bank would provide a loan for the remaining $20,800,000.

Apartment Community is Built and Leasing Starts

The proposed Unit Mix is gathered with the rent schedule from the developer’s property management to determine the rents this asset can collect and stay at 93% occupied.

Permanent Loan Constraints – LTV and DSCR

To achieve the goal of recouping the original cash invested, the developer must meet 2 permanent lender benchmarks, loan-to-VALUE (LTV) and debt service coverage ratio (DSCR). The developer prepares a Pro Forma operating statement that generates cash flows to 1) overcome the DSCR constraint and 2) create value higher than the cost to build the apartment community to overcome the LTV hurdle.

LTV

Permanent lenders have another constraint called loan-to-VALUE (LTV). This value is directly related to the apartment community’s cash flow and an appraiser’s cap rate that will be assigned.

Cap Rate

The capitalization rate (cap rate) is the rate at which net operating income (NOI) is discounted to determine the value of a property. It is one method that is utilized to estimate property value. Capitalization rates are applied to NOI to estimate a property’s value. Generally, higher cap rate indicate higher expected returns and higher perceived risk.

LTV can lead to higher proceeds as it is used to express the amount of a proposed loan as a percentage (typically up to 75%) of the property’s appraised value. The value the developer creates is the gap between the construction lender’s loan-to-COST and the permanent lender’s loan-to-VALUE.

Project costs equal $26 million. In order to recoup initial funding, the target permanent loan amount should be at least $26 million. This amount is then divided by the 75% loan-to-value parameter of a permanent loan to indicate a target value needed of $34,666,667 to support the $26 million loan.

DSCR

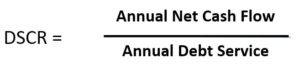

Debt service coverage ratio is the amount of cash flow necessary to make the annual principle and interest payment on the debt. For apartments, the ratio tends to be a minimum 1.25x of the annual net cash flow.

Loan Sizer

To apply lender constraints and industry standard assumptions to get to the TARGET LOAN AMOUNT, and return the original equity to the developer, we developed a tool called a “LOAN SIZER”. The “Loan Sizer” allows for the cash flow to be analyzed to meet the LTV and DSCR constraints.

Next we determine anticipated revenues and expenses to establish a net income that will justify an asset value of $34,666,667 and meet the 1.25 debt coverage ratio. We use the “Loan Sizer” below to analyze the cash flows needed to hit our targets. We effectively worked our cash flows out to determine the NOI required is $2,192,898 to hit the DSCR test and Loan-to-value test.

We close the permanent loan for $26 million and then Holderby recoups the original investment of $5.2 million. The cycle begins again. Developers that understand the method and have the discipline to follow budget and cash flow projections achieve their commercial real estate financial goals and become “serial developers”.